Ant trapped? China pushes fintech giant to overhaul its business

Move is part of Beijing’s clampdown on technology firms that have come to dominate e-commerce and financial services.

China’s central bank says it has asked the country’s payments giant Ant Group Co Ltd to shake up its lending and other consumer finance operations, the latest blow to its billionaire founder and controlling shareholder Jack Ma.

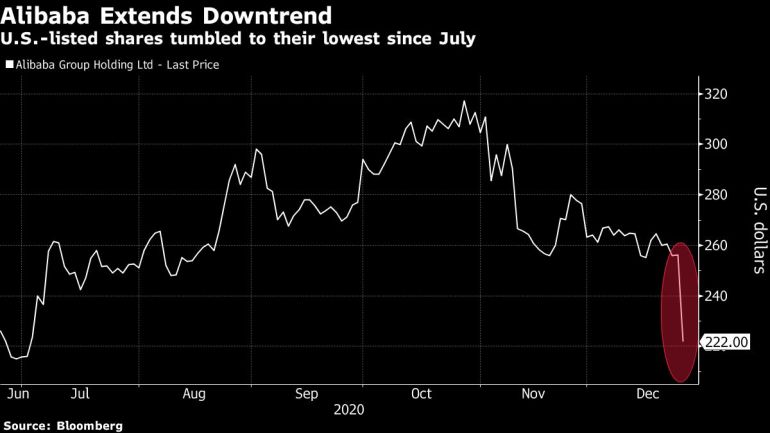

The announcement came more than a month after Chinese regulators abruptly suspended Ant’s blockbuster $37bn initial public offering in Shanghai and Hong Kong and only days after the country’s antitrust authorities said they had launched a probe into Ma’s e-commerce conglomerate Alibaba Group Holding Ltd.

Chinese regulators and Communist Party officials have set about reining in Ma’s sprawling financial empire after he publicly criticised the country’s regulatory system in October for stifling innovation.

Regulators have urged Ant to rectify financial regulatory violations, including in its credit, insurance and wealth management businesses and overhaul its credit rating business to protect personal information, People’s Bank of China (PBOC) Vice Governor Pan Gongsheng said on Sunday.

Pan’s comments stopped short of calling for a breakup of Ant, yet pointed to a significant operational restructuring. Ant should set up a separate holding company to ensure capital adequacy and regulatory compliance, Pan said.

Ant should also be fully licensed to operate its personal credit business and be more transparent about its third-party payment transactions and not engage in unfair competition, Pan added.

The Hangzhou-based firm now needs to move forward with setting up a separate financial holding company to ensure it has sufficient capital and protect personal private data, the central bank said.

Ambitions curtailed?

Ant said in a statement it would establish a “rectification” working group and fully implement regulatory requirements.

The series of edicts represent a serious threat to the expansion of Ma’s online finance empire, which has grown rapidly from a PayPal-like operation into a full suite of services over the past 17 years.

Before regulators intervened, Ant’s public listing would have valued it at more than $300bn, with existing backers including United States-based private equity firms Carlyle Group Inc and Silver Lake Management LLC.

“This is the culmination of a string of regulations and sets the direction for Ant’s business going forward,” Zhang Xiaoxi, a Beijing-based analyst at Gavekal Dragonomics, told the Bloomberg news agency. “We haven’t seen clear indication of breakup yet. Ant is a giant player in the world and any breakup needs be to be cautious.”

[Bloomberg]

[Bloomberg]Ma was advised by the Chinese government to stay in the country, Bloomberg has reported, citing a person familiar with the matter. Ma could not be reached for comment, the Reuters news agency said.

Pan said Ant representatives met on Saturday with officials from the PBOC and other Chinese banking, securities and foreign exchange regulators.

Defiance of regulations

During the meeting, regulators pointed out Ant’s issues including its poor corporate governance, defiance of regulatory demands, the use of its market advantage to squeeze out competitors and harming consumers’ legal interests, according to Pan.

The central bank said Ant used its dominance to exclude rivals, hurting the interests of its hundreds of millions of consumers.

Ant was launched in 2004 and is 33 percent owned by Alibaba. Its Alipay app dominates digital payments in China, with more than 730 million monthly users. The Hangzhou-based company also built an empire connecting China’s borrowers and lenders, securing short-term loans within minutes.

Last month, China issued draft rules aimed at preventing monopolistic behaviour by internet firms and the Politburo this month promised to strengthen anti-monopoly efforts in 2021 and rein in “disorderly capital expansion”.

China also warned internet giants this month to brace for increased scrutiny, as it slapped fines and announced probes into mergers involving Alibaba and Tencent Holdings Ltd.

Source: Thanks AlJazeera.com