Egypt’s bond market, already red hot, could get even hotter

JPMorgan Chase will add Egypt to a group of indexes, setting the market up to receive an influx of cash from passive money managers.

By Bloomberg

Published On 11 Jan 2022

Egypt’s red-hot bond market has made it a favorite of emerging-market investors, and they’re counting on another year of big gains.

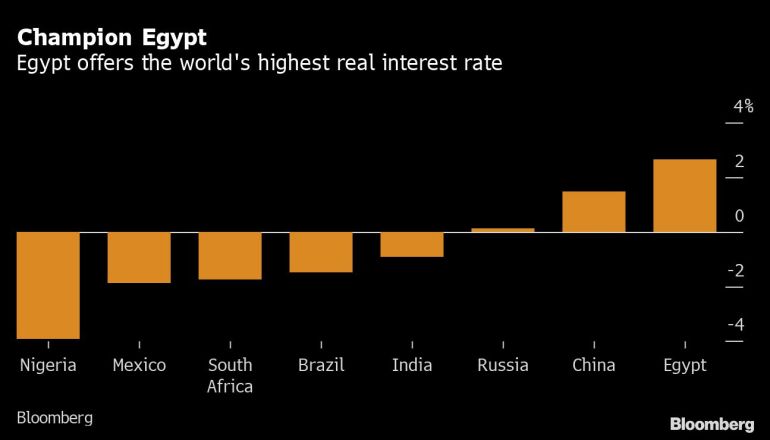

JPMorgan Chase & Co. will add Egypt – which has $26 billion of eligible government bonds – to a group of indexes this month, setting the market up to receive an influx of cash from passive money managers. Investors have already been enticed by Egypt’s hefty interest rates, which rank as the highest in the world after adjusting for inflation.

With global bond markets reeling from losses as the Federal Reserve turns hawkish, Egypt is looking like a bright spot for investors. Local bonds have returned 1.7% since December, making it one of only a handful of emerging markets that’s delivered a positive performance.

PineBridge Investments and Renaissance Capital say they expect the strong performance to continue and predict double-digit gains in 2022 — adding to last year’s 13% return, which was the second-best in the world and compared with an average loss of 1.2% for local emerging market debt.

Local-currency bonds from the North African nation may return 17% this year, according to Anders Faergemann, a money manager at PineBridge in London.

“The disinflation process is still intact and the exchange rate is fairly valued,” he said.

In the long run, Egypt’s bond market track record is even better. Its local bonds have returned 156% in dollar terms over the past five years as reforms under deals with the International Monetary Fund and financing from Gulf Arab allies attracted inflows. That compares with 26% for Bloomberg’s emerging market index and even beats the S&P 500 index, which returned 133%.

Its dollar bonds are another story, with hard-currency debt bearing the brunt of risks from rising Treasury yields and the country’s deficits. Having lost 8% last year, investors now demand an extra premium to hold Egypt’s dollar debt — which at 593 basis points is similar to Iraq and higher than Gabon and Pakistan.

Real Rates

Still, the country’s local currency bonds are bucking the global trend of negative returns as inflation remains below central bank rates. Egypt’s so-called real interest rate – the difference between its deposit rate and inflation – is 2.35%, compared with negative 6.55% for the U.S.

“With real rates that high, we don’t think the Fed raising rates modestly this year will be a key driver for Egypt bonds,” said Jim Barrineau, New York-based head of emerging-market debt at Schroders. “The ability to keep inflation relatively contained has been key.”

(Adds eligible bonds in 2nd paragraph, updates numbers throughout)

Source: Thanks AlJazeera.com