The Sharemarket’s Best Kept Secrets

There’s no better time to think big and get your message out to the market

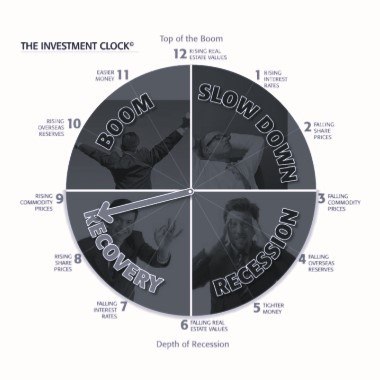

The CEO’s of listed small-cap companies are now in the box seat to get above the noise in the market during the current part of the market cycle. A further lowering of the cash rate by 25 basis points by the RBA earlier this month to 2% creates a perfect storm of opportunity. This move will propel new and existing investors into the sharemarket looking for yield and growth potential to compete against a low return on cash investments and the dreaded inflation bogey. The long period of volatile and unfavourable equity markets, experienced since 2009, is now well and truly over and has now turned into opportunity. This part of the cycle has created a renewed interest in share investment not seen since before the last sharemarket boom of 2007.

The All Ordinaries Index has the best chance in years to go through the 6,000 barrier and to ultimately surpass its all time high of 6,800 reached in November 2007. This timing is conducive for the small-cap sector of the market to be heard with some voice in the wider investment community. The next few years will not be all about the big end of town. Indeed, any recovery in this part of the cycle is likely to initially focus on the big end of town, with companies that feature in the Top 100 to 200 shares, and then, as these shares get fully priced with price-to-earnings ratios nearing the top end of the range at 20 times or more, attention will move towards the remaining value at the small-cap end of the market.

If you are a small-cap company there are still many ways for the CEO to begin the process of getting the message out while the initial focus is on the big players in the market. The success of this approach can ultimately see the company more widely recognised early on, as the attention turns to the small-caps, and eventually create some real wealth for shareholders. In history, small-cap companies in the recovery and boom phase of the market have often been recognised as some of the best performers and can reward shareholders many times over. If you get this approach right you could become the next 5, 10, or 20 bagger.

How does a CEO set their company up for some serious market attention?

One of the greatest difficulties for a CEO of a listed small-cap company is actually recognising who to communicate with. Some companies don’t actually look beyond their own shareholders. Even these shareholders can often be ignored. What about sending each new shareholder a ‘Welcome Kit’? Or making sure that the company website has an active ‘Investor Section’ that deals with all the latest information about the company? A Quarterly Newsletter to existing shareholders can also be an extremely useful way of keeping these stakeholders informed and provide a heightened awareness about the company, its current activities and its Board and management team. Other stakeholders that will be very interested in the performance of a company in this sector include brokers, analysts, fund managers, small-cap institutions, private investors and the business media.

It is not simply a matter of issuing a release to the ASX and expecting that any interested party will somehow seek this information out from the ASX website. The CEO needs to fully embrace the investor relations process and develop a target list of stakeholders that need to receive regular communication. A company’s share price is built on the expectations that investors hold about its future prospects, but with past performance, management credibility, customer value proposition and competitive position being the key reference points. This is where the investor relations process comes in to ensure that the widest possible audience is fully up-to-date with the issues that drive performance and the strategies that will drive growth for the company.

Don’t make the mistake of communicating too early and too often to this target list, as this can work against the company. It is preferable to only issue information that is informative and may have some real impact on the prospects for the company in the future. It may also be useful to conduct a series of road shows and presentations to the market on at least a Quarterly basis and invite existing and prospective investors, brokers and analysts and the business media. It is all about building trust, gaining market exposure and committed interest.

The CEO may chose to do the investor relations work alone or engage with a professional company that specialises in this sector. Investor relations is still relatively new to Australia yet widely known and accepted in the US and UK. It is not unusual in these markets to see the name of the investor relations company appear in the Annual Report alongside the company’s accounting and legal advisers. A company performing this role, in conjunction with the CEO, enables a consistent and orchestrated campaign to be undertaken over a period of time, several years in some circumstances. This also frees up the CEO to concentrate on the all important task of running the company. These services may also include producing a company profile or research note that can often form the basis of a detailed broker research report once the company’s market capitalisation reaches about $100 million. Other services could include crafting and communicating the media release, providing fact sheets and background reviews. It could also involve, in the case of a mining and resource company, turning ‘geo speak’ into simple, plain English.

It is important for the CEO to communicate to the market in a language it understands and this is where investor relations professionals can be of the greatest assistance. The aim is to get the company onto the radar screens, boost liquidity in the stock and ultimately enhance the share price by delivering a consistent clear message to the sharemarket.

Remember, what all investors want to know is that the company is focussed on the growth of the business, its investment proposition, customer value proposition and the sustainable competitive advantage. Often investors ask, what makes a share price go up? By delivering consistent and sustainable earnings with no shocks is always a good start.

Source: Thanks boursecommunications.com.au